Payroll: Manage Payroll Options

ABOUT THE PAY APPLICATION

The Pay application contains links to payroll-related tasks and information. The links that display may depend on how your organization has configured Workday. Use these links and options to do the following:

- Withholding Elections: View withholding information on the State Elections tab and View/Modify your Federal Elections.

- Payment Elections: Distribute payroll and expense payments between different bank accounts (checking or savings), and specify the payment method, such as check or direct deposit.

- Payslips: View and print payslips or change your payslip printing election. You may view payslips for any previous period when the data is provided.

- Timesheets: Record work hours for submission, approval, and eventual payment through payroll (if enabled).

- Bonus and One-Time Payment History: Review payments received outside of the regularly scheduled payroll process, such as bonuses.

- My Tax Documents: View the annual tax documents associated with your earnings.

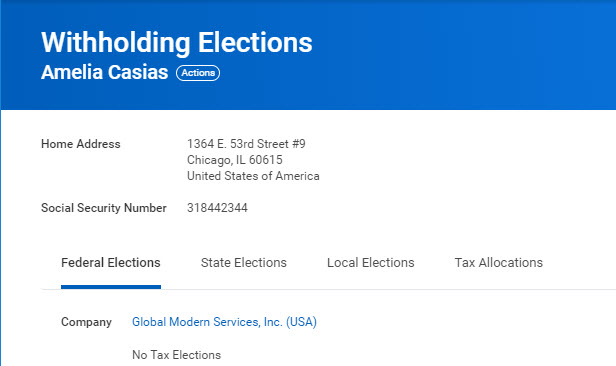

VIEW YOUR WITHHOLDING DEDUCTIONS

From the Pay application:

- Click Withholding Elections under Actions.

- View your Federal Elections or click the State Elections, Local Elections, or Tax Allocations tabs to review your status.

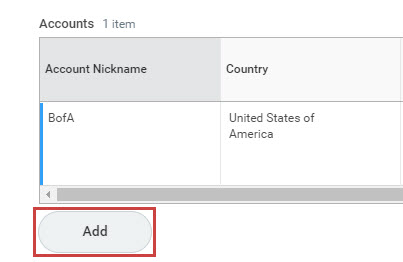

ADD A DIRECT DEPOSIT ACCOUNT

From the Pay application:

- Click Payment Elections under Actions.

- Click Add.

- Optionally, you can add a Nickname to help you identify this account.

- Select the Account Type and enter the Bank Name, Routing Transit Number, and Account Number.

- Additionally, you can enter a Bank Identification Code.

- Click OK to save. Once the account has been added, you may use it to make payment elections.

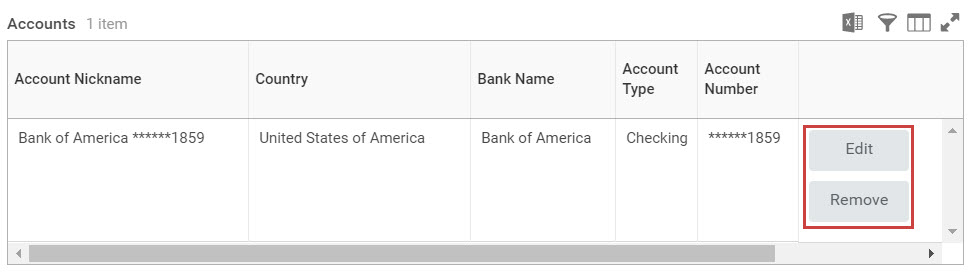

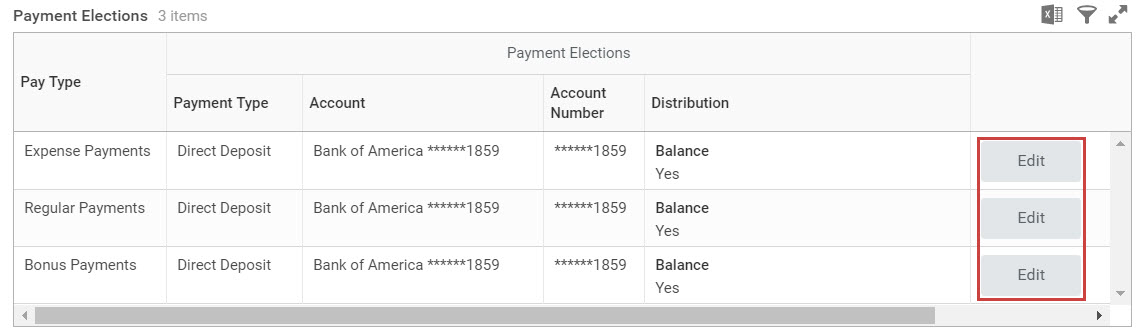

MANAGE YOUR PAYMENT ELECTIONS

From the Pay application:

- Click Payment Elections under Actions.

- Edit or remove bank accounts using the Edit or Remove buttons. An account can only be deleted if it is no longer used as a payment election.

- Click Edit in the Payment Elections section to modify a payment election.

- Change the amount or percent that goes to the account or the account that receives the balance of payments for the pay type. Your organization’s payment elections policy determines what changes are allowed.

- Click OK to save.

PRINT PAYSLIPS

From the Pay application:

- Click Payslips under the View section.

- Here you can view a list of all payslips. Click the Print button next to a payslip name. You can also View the payslip and save it to your computer as a PDF.

- To print multiple payslips, click Print Multiple Payslips.

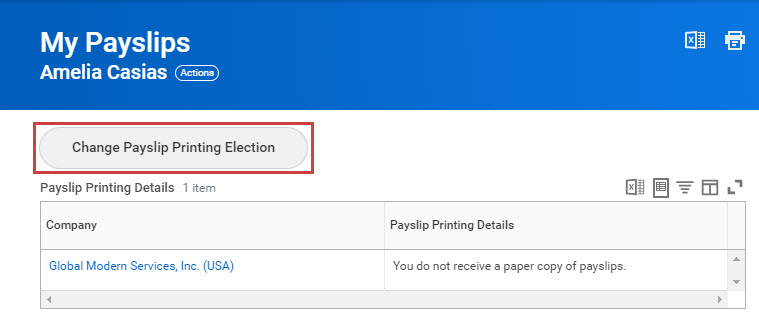

CHANGE PAYSLIP PRINTING ELECTION

From the Pay application:

- Click Payslips.

- Click Change Payslip Printing Election.

- Your name and organization information auto-populate. Click OK to continue.

- Click the New Payslip Printing Election prompt to view the available options.

- Select from the displayed options.

- Click OK, then Done to complete the process.

VIEW BONUS AND ONE-TIME PAYMENT HISTORY

From the Pay application:

- Click Bonus & One-Time Payment History under View.

- Review your bonus and one-time payment history.

VIEW YOUR TAX DOCUMENTS

From the Pay application:

- Click My Tax Documents under View.

- Review the documents Workday has on file for you.