Federal Student Loan Repayment

The University of San Francisco Office of Financial Aid wants to be sure you get up-to-date and accurate information about your federal student loans. We also want to supply any help needed to begin repayment of these loans. That's why we've partnered with Student Connections to provide you with additional support.

Loan Forgiveness Update:

- The Supreme Court has ruled against the proposed one-time student loan cancellation based on income.

- No one who applied and was approved will receive the one-time federal student loan debt relief.

Payment Pause Update:

- All borrowers in the payment pause will start making payments in October 2023.

- Borrowers who left school April 2023 or later are an exception. They're still in their automatic grace period and will begin payments when it concludes.

- You'll get your bill (including your payment amount and due date) at least 21 days before your due date.

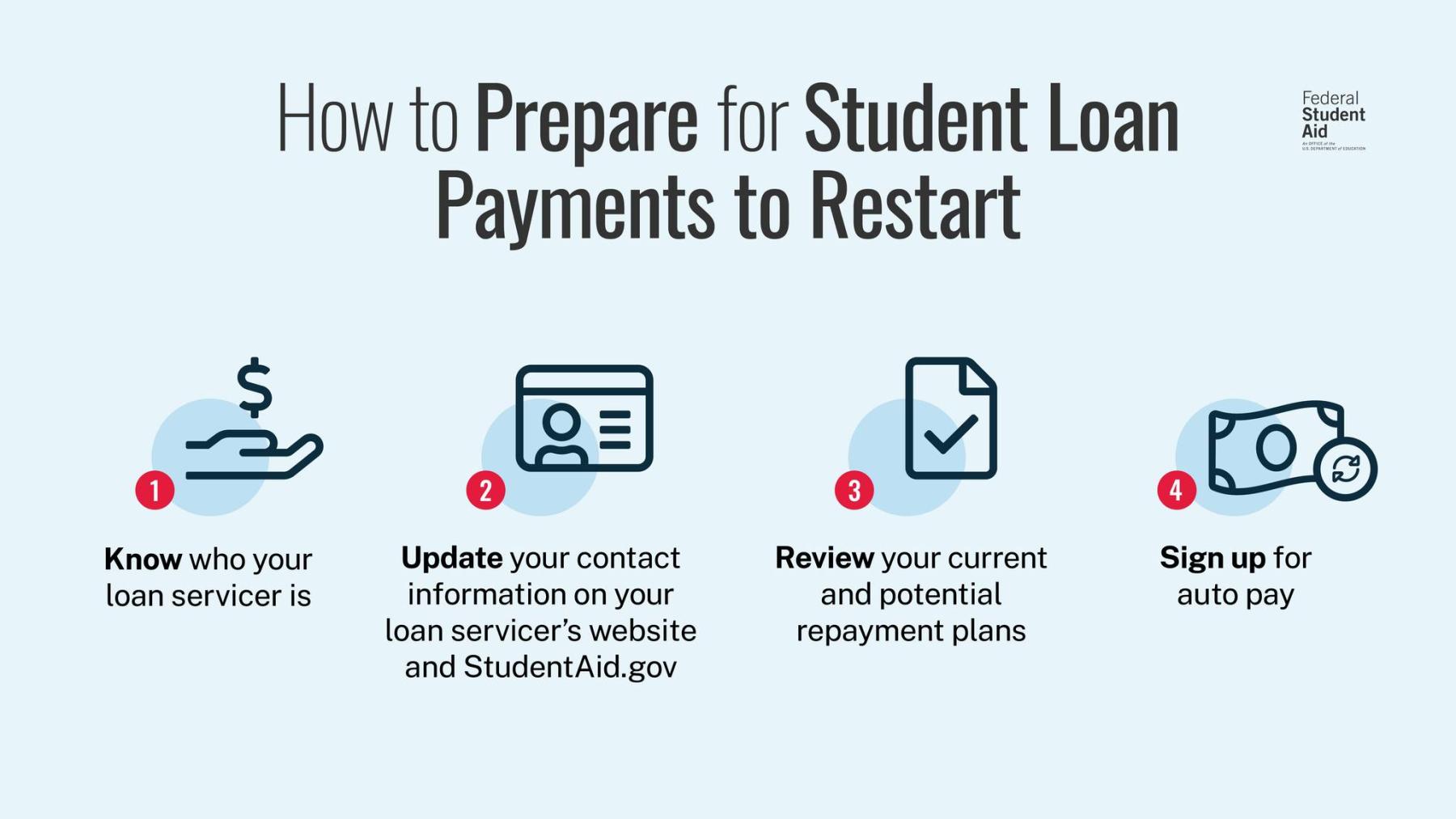

Take These Steps Now

Repayment starts October 2023. Follow these steps to get ready.

- Get access to your student loan data on StudentAid.gov and your federal loan servicer's website.

- Use your loan servicer's website to answer some basic questions about how much you owe, your payment amount, and your due date.

- Keep yourself in the loop about ongoing efforts to supply debt relief and support to student loan borrowers.

- Prepare to start making payments.

Worried about Affording Your Monthly Payments?

Don't panic. You're not alone. Millions of student loan borrowers will struggle as repayment begins. The good news is there are many repayment options for borrowers facing financial hardship. Depending on your income, monthly payments can be reduced to zero dollars.

The Borrower Advocates at Student Connections can help answer any questions you have and determine what steps you need to take. This service is completely free to you!

Questions about Student Loan Repayment?

In October 2023, 30 million borrowers will begin repayment at the same time. The existing support network will be strained, making it difficult to reach a person who can answer your questions. That's where Student Connections can help!

Student Connections is passionate about helping students. They partner with schools to provide support for borrowers throughout the student loan repayment process. With more than 60 years of experience in counseling student loan borrowers, their primary goal is to help you find the repayment plan that best fits your needs.

While you are in student loan repayment, Student Connections may contact you through emails, text messages, and phone calls to:

- Help you understand your loan obligations and responsibilities.

- Discuss available options for an affordable repayment plan.

- Ensure you are aware of repayment options during financial hardships.

- Promote your long-term repayment success.

Talk to a Borrower Advocate for free at (866) 311-9450. They're available to answer questions about your outstanding loans and will work directly with you and your loan servicer when appropriate.

Avoid Student Loan Debt Relief Scams

Federal Student Aid (FSA) continues to warn borrowers about student loan scams. With so many recent efforts to create new programs that provide relief, even savvy borrowers might find it hard to tell the difference between a scam and legitimate forgiveness and relief efforts. Learn More.

Beware of any source that is not directing you to FSA or your loan servicer.