Steps to Apply for a PLUS Loan

To apply for a Federal Direct PLUS Loan, a parent or graduate student needs to complete the following steps:

- Complete the Free Application for Federal Student Aid (FAFSA): This form helps determine your eligibility for financial aid; including federal loans.

- Visit the Federal Student Aid website: Go to StudentAid.gov and log in using the Federal Student Aid ID (FSA ID). Please note: parent borrowers must log in using their own FSA ID credentials.

- Select "Apply for a Direct PLUS Loan": This option will guide you through the application process for the PLUS Loan.

- Provide personal and financial information: This includes details like your name, Social Security number, address, and income information.

- Undergo a credit check: The applicant's credit history will be checked to assess eligibility. If the applicant has adverse credit history, they may need a co-signer or demonstrate extenuating circumstances to be considered. (See the Federal Direct PLUS Loan denial process below).

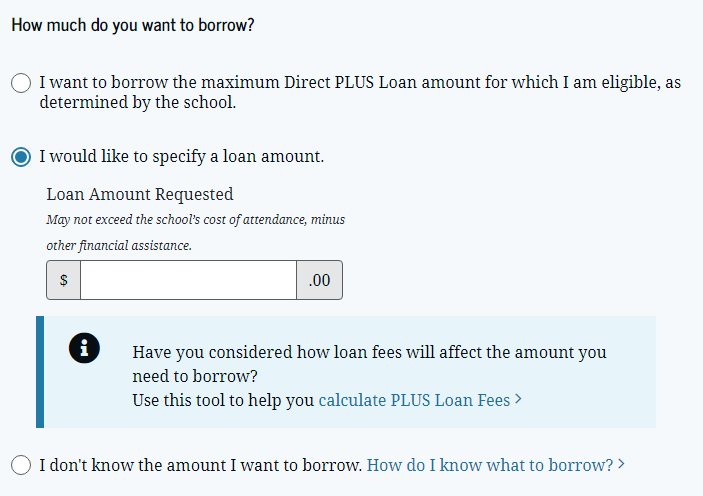

- Select how much you want to borrow: Enter the amount you are requesting to borrow. Consider requesting the minimum amount needed even if you are eligible to borrow more as loans require repayment. Also, consider the amount of loan fees assessed to your requested amount.

- Borrow the maximum Direct PLUS Loan Amount: If you select this option, USF will process the PLUS Loan application for the maximum amount you or the student is eligible for. You may contact the Financial Aid office to request a lower amount after submitting the PLUS Loan application.

- Specify a loan amount: If you select this option, USF will process your requested amount or reduce the loan amount to the maximum amount if the full amount cannot be processed.

- Undecided loan amount: If you select this option, USF will process the maximum amount you or the student is eligible for. You may contact the Financial Aid office to request a lower amount after submitting the PLUS Loan application.

- Select the appropriate loan period: This involves choosing the academic year or specific period for which you need the loan funds. Typically, this coincides with the schools' academic calendar.

- Example loan period for the 2025-2026 academic year:

- 08/2025- 05/2026: These dates covers the fall 2025 and spring 2026 semesters.

- 08/2025- 12/2025: These dates covers the fall 2025 semester only.

- 01/2026- 05/2026: These dates covers the spring 2026 semester only.

- 05/2026- 08/2026: These dates covers the summer 2026 semester only

- Example loan period for the 2025-2026 academic year:

- Review and sign the Master Promissory Note (MPN): This document outlines the terms and conditions of the loan, including repayment responsibilities and interest rates. It is a legal agreement between the borrower and the lender.

- Receive loan approval: If approved, the funds will be disbursed directly to the school to cover tuition, fees, and other educational expenses.

- Repay the loan: Repayment typically begins after the loan is fully disbursed. Options for repayment plans and deferment may be available depending on the circumstances.

Note: It will take 1-3 business days for the Financial Aid Office to receive and process Direct PLUS Loan applications.